what is suta tax on my paycheck

Just like any of your small business taxes the SUTA tax is an essential payroll tax that needs to be paid on time. Generally states have a.

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

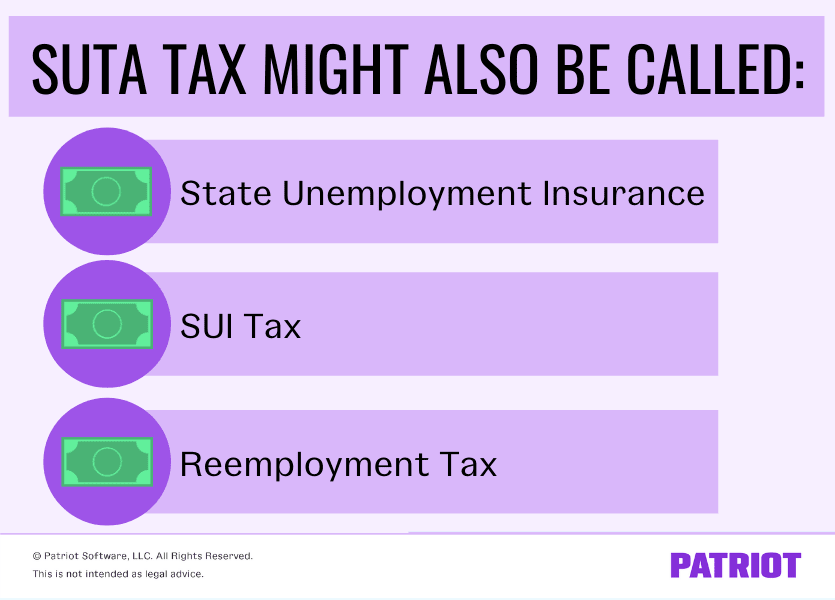

The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. There is no maximum tax.

The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. It is one of the employers business costs. What are unemployment tax rates.

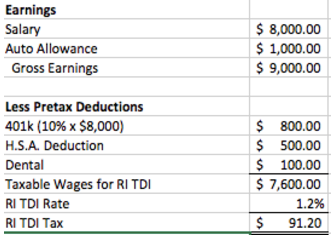

The taxable wage base or amount of wages that are taxable under. In some cases however the employee may also have to pay. Each state establishes its own tax rate.

The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. Nonprofit organization as defined in Section 3306c8 of the Federal Unemployment Tax Act and.

There is no taxable wage limit. The federal government applies a standard 6. 4 rows FUTA is federally managed and states regulate SUTA.

Under SUTAs tax rates in each state range from a low of 1 to 34. Its a payroll tax that many states impose on employers in order to fund state unemployment. If an employer has no paid taxable payroll during the four-year period ending June 30th of the prior year they are assigned the maximum base tax rate of 62.

What are my options if Im unable to file my taxes by the extension deadline. Each state establishes its. What does Suta mean on my paycheck.

Florida employers pay reemployment tax. I was going to to either pay additional payments so Im overpaid or just file the best return I can and then amend. Equal Opportunity is the Law.

52 rows You may receive an updated SUTA tax rate within one year or a few years. Review the PIT withholding schedule. SUTA and FUTA tax rates Each state has its own SUTA tax rates ranging from 065 to 68 The wage base limit or the maximum threshold for which the SUTA taxes can.

The State Unemployment Tax Act SUTA is essentially FUTA on the state level. Unemployment Insurance Employer Handbook. This means that the employer.

Most states send employers a new SUTA tax rate each year. The withholding rate is based on the employees Form W-4 or DE 4. SUTA stands for State Unemployment Tax Act.

SUTA stands for State Unemployment Tax Act. Not only is it a required employee benefit but it could also help. State Unemployment Tax Act SUTA Indiana Code 22 Article 4.

Understanding Your Paycheck Credit Com

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

What Is The Suta Tax And Why Is It Going Up In 2021 Fourth

What Is Suta Tax Definition Rates Example More

How Are State Disability Insurance Sdi Payroll Taxes Calculated

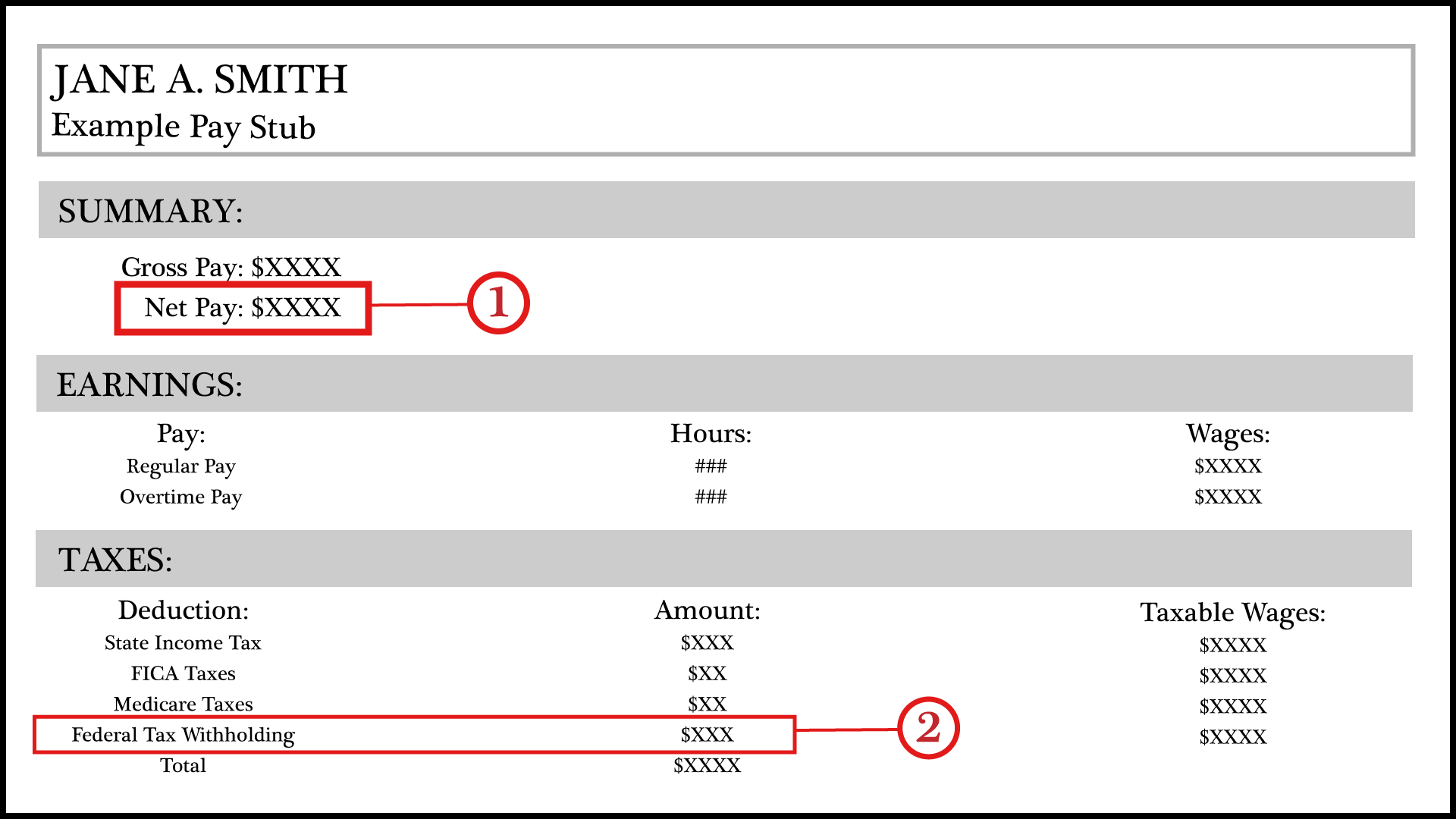

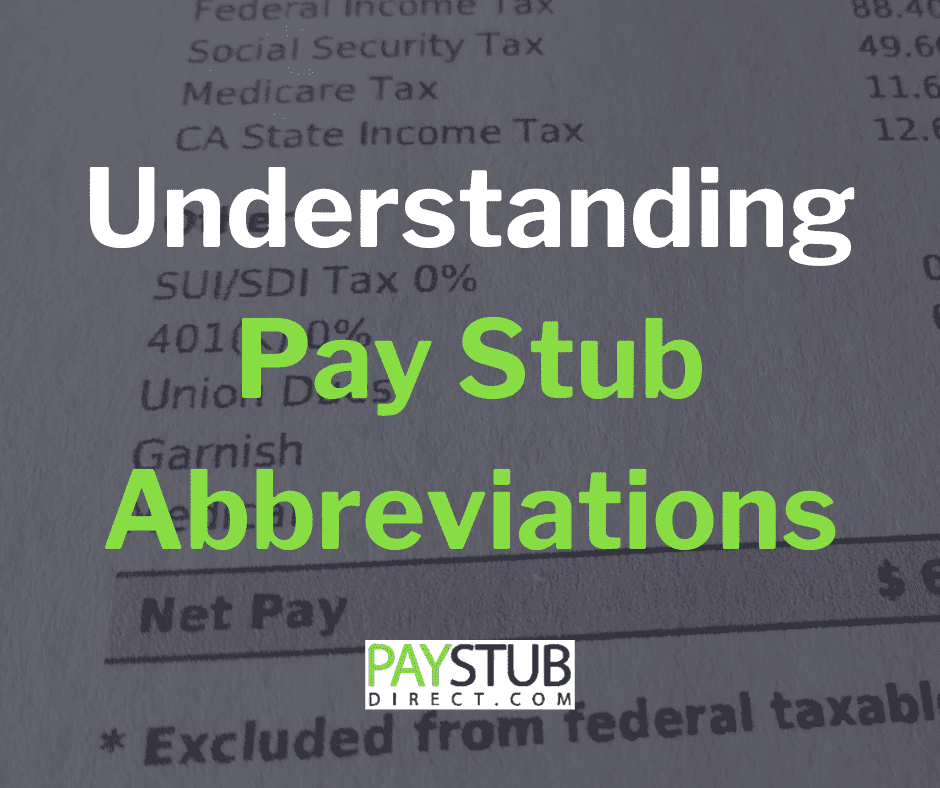

Understanding Different Pay Stub Abbreviations

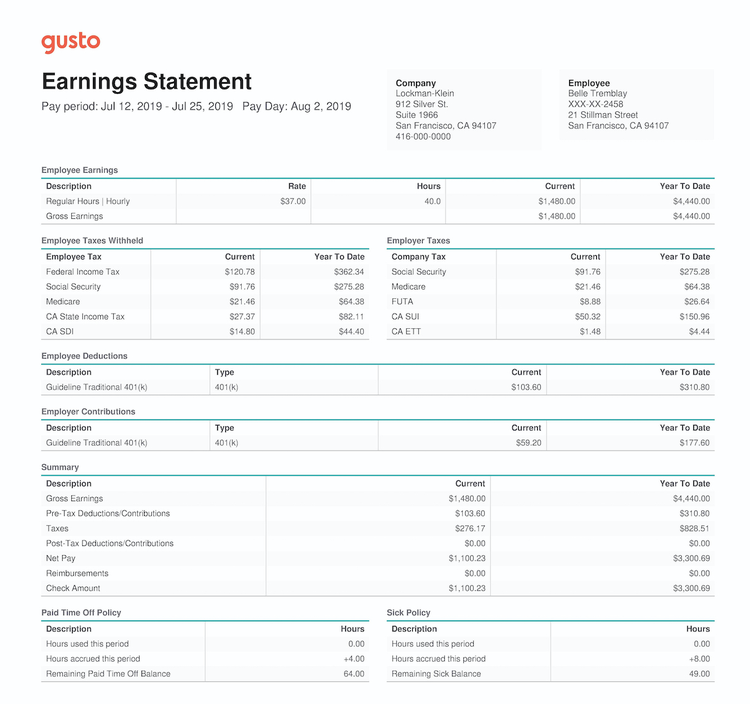

Understanding Your Pay Stub Form Pros

Payroll Taxes Explained Hourly Inc

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

How To Calculate Payroll Taxes For Your Small Business

Visualizing Taxes Deducted From Your Paycheck In Every State

Explaining Paychecks To Your Employees

Our Company Is Agricultural And Not Required To Pay Futa Or Suta How Can I Reflect This In Quickbooks So It Stops Calculating Those Taxes

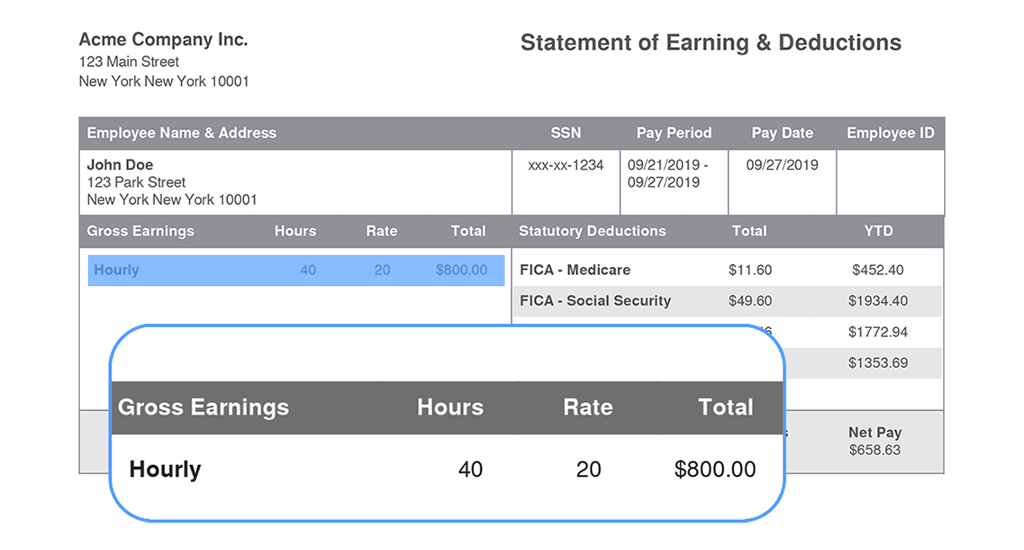

Gross Wages What Is It And How Do You Calculate It

How To Calculate Missouri Income Tax Withholdings

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

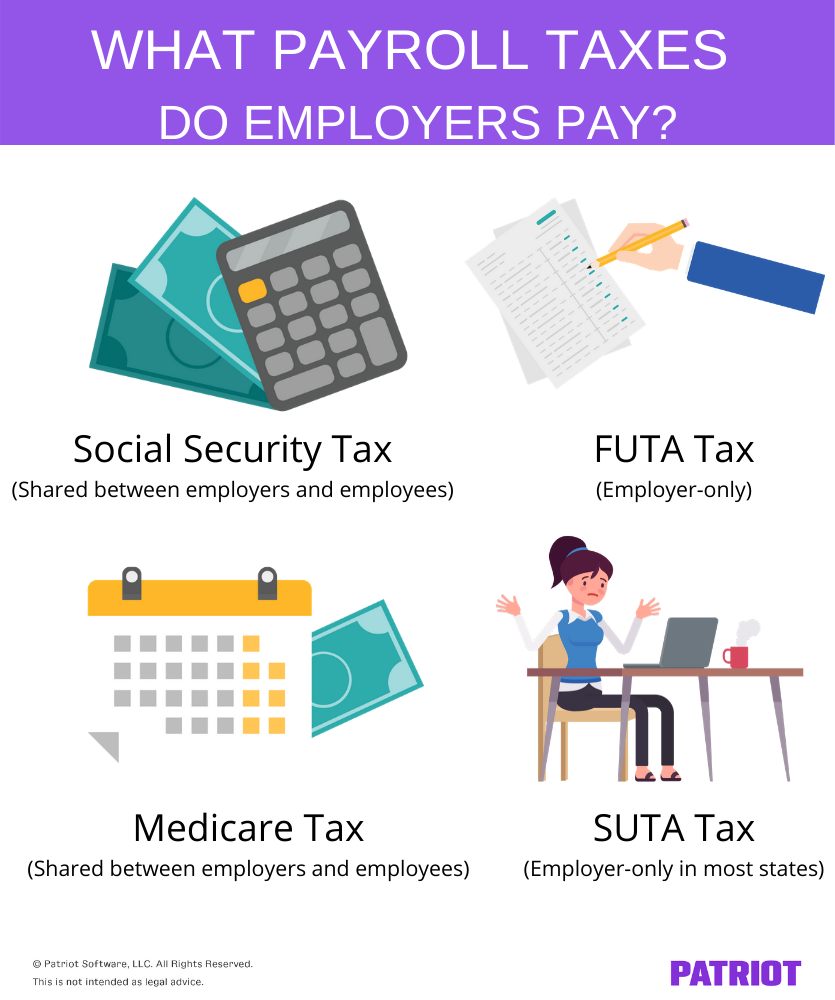

Payroll Taxes Paid By Employer Overview Of Employer Liabilities